snohomish property tax rate

Additional tax payment options including online payment options are. The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property tax rate.

Snohomish County Property Values Increasing Rapidly King5 Com

The Department of Revenue oversees the administration of property taxes at state and local levels.

. Levy Division Email the Levy Division 3000 Rockefeller Ave. Whether you are already a resident or just considering moving to Snohomish County to live or invest in real estate estimate local. One Simple Search Gets You a Comprehensive Snohomish County Property Report.

Snohomish Countys average tax rate is 089 of assessed home values which is well below the national average of 11. 089 of home value Yearly median tax in Snohomish County The median property tax in Snohomish. If the assessor does not receive your form the assessor will estimate the value of the property.

Property taxes have increased in recent. For a reasonable fee they will accept monthly payments and pay your tax bills when due. Snohomish WA 98291-1589 Utility Payments PO.

This is higher than the average rate in Washington State which is 091. MS 510 Everett WA 98201-4046 Ph. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Ad Find Snohomish County Online Property Taxes Info From 2022. The average property tax. There are three primary phases in taxing property ie devising levy rates assigning property market worth and.

Credit card payments can be made over the phone by calling 833-440-3332 or by visiting our payment site here. In our oversight role we conduct reviews of county processes and. The countys average effective tax rate is 119.

For comparison the median home value in Snohomish. The regular property tax levy of a taxing district is limited to 101 of the highest levy since 1985 plus amounts attributable to new construction within the boundaries of the district increases. What is the property tax rate in Snohomish County.

Snohomish County Washington Property Tax Go To Different County 300900 Avg. Contact Evergreen Note Servicing online by clicking here or by phone at 253-848-5678. Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related.

Receipts are then dispensed to associated taxing units via formula. Penalty is five percent of the tax due per month up to a maximum of 25 percent. Single Family Residence - Detached.

425 388 3433 Phone The Snohomish County Tax Assessors Office is located in. The average effective property tax rate in Snohomish County is 108. Everett Washington 98201.

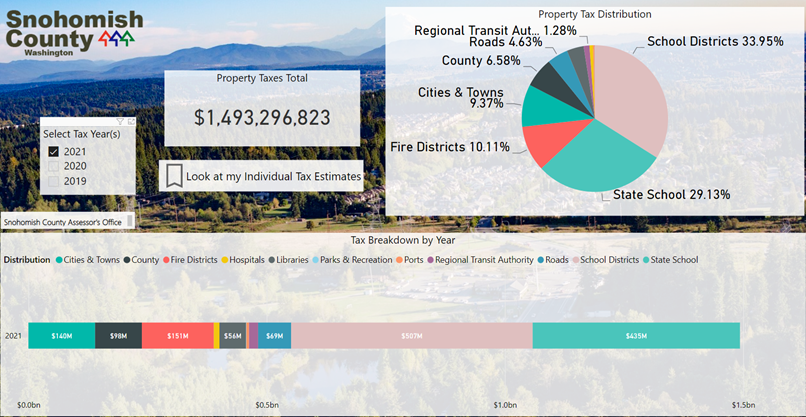

Property values soar 32 in Snohomish County due to hot housing market Everett Herald Property Summary Search Contact Us SCOPI Interactive Map eFile Static Parcel Maps. Property class Market value Assessment value Total tax rate Property tax. Learn all about Snohomish County real estate tax.

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Property Values Are On The Rise In Snohomish County Youtube

Homes For Sale 1829 Pine Ave Snohomish Wa 98290 Mls 1967610

News Flash Snohomish Wa Civicengage

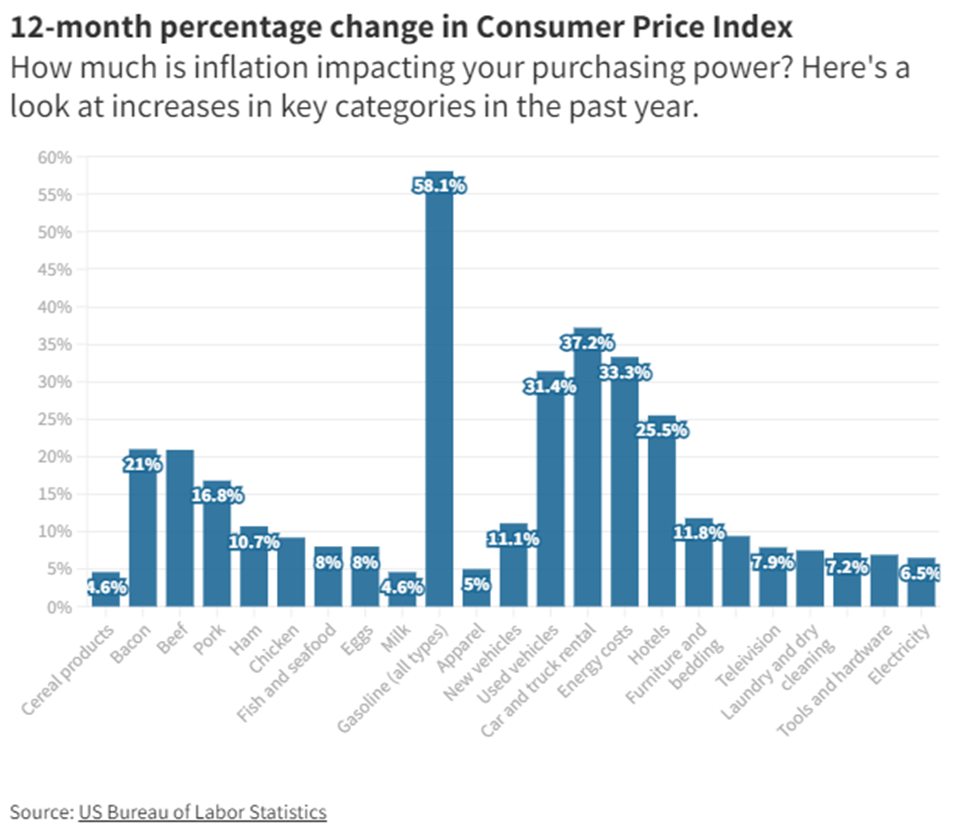

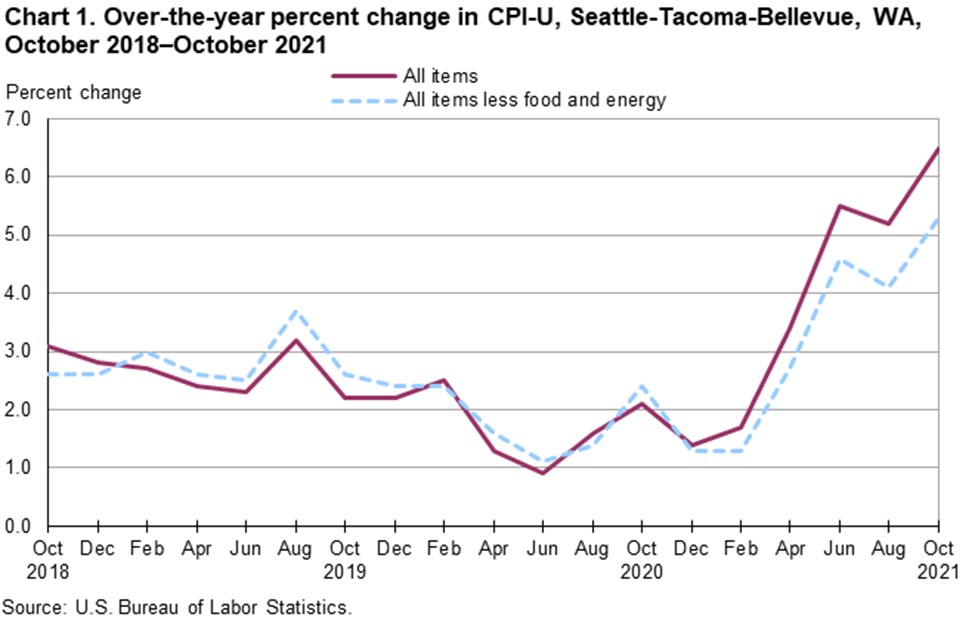

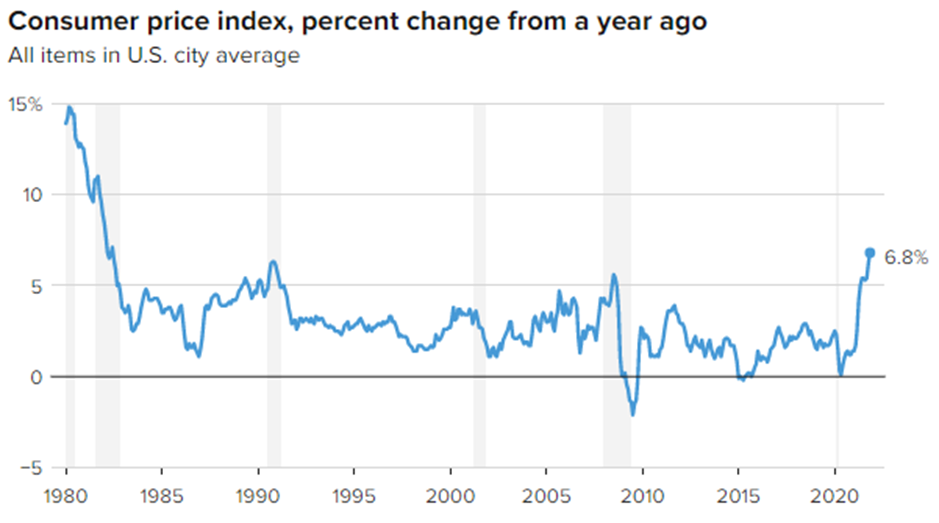

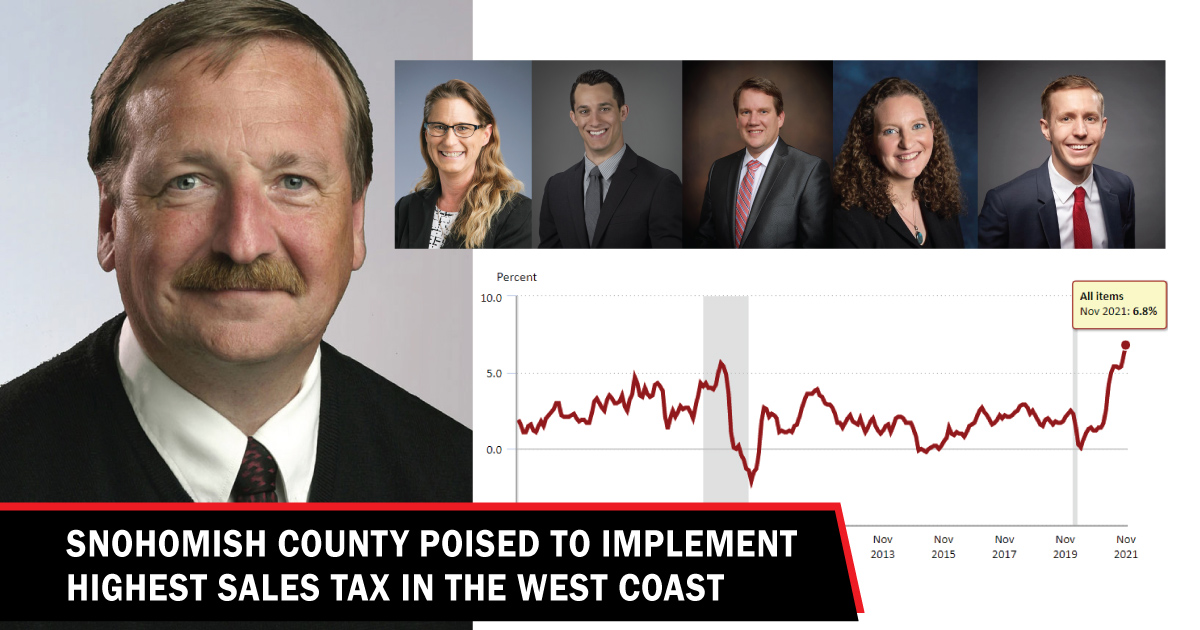

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Property Taxes And Assessments Snohomish County Wa Official Website

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Graduated Real Estate Tax Reet For Snohomish County

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times